Markets enact social control while making it seem to disappear

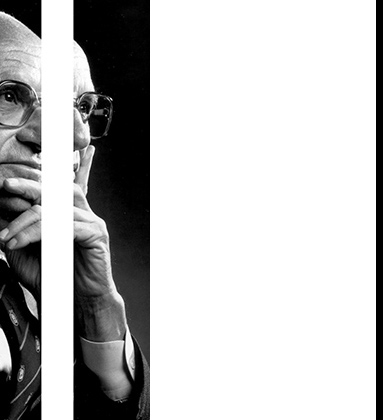

Milton Friedman famously argued that there is a link between capitalism and freedom. “A society which is socialist,” he wrote in Capitalism and Freedom, “cannot also be democratic, in the sense of guaranteeing individual freedom.” As an empirical matter, that statement remains as roughly true now as Friedman’s related claim that there is “no example in time or place of a society that has been marked by a large measure of political freedom, and that has not also used something comparable to a free market to organize the bulk of economic activity.” A socialist might quibble that the assertion is crafted to elide very stark distinctions between societies, hiding some important dimensions in which politically free Sweden, for example, diverges in economic policy from the laissez-faire Anglosphere. But even in the social-democratic Nordics, much of economic life, the “bulk” perhaps, plays out through money-intermediated arrangements between nonstate actors. That is, in markets.

The interesting question is why. Why does there seem to be a relationship between capitalism and political freedom? Friedman emphasizes the role of competitive and decentralized market actors in checking the concentration of power that political authorities might use to prevent freedom and dissent. If one is fired by a private employer for expounding unpopular views, there is always another private employer who may have different views. If employment is directed by a hierarchical state, the cost of dissidence may be penury or starvation.

Friedman argues that economic freedom, in constituting the individuals’ ability to engage in whatever voluntary activities they wish to pursue, including exchanges of goods or services for money, is not only a means toward, but is freedom itself. But what is freedom, itself?

There is another way of accounting for the apparent coincidence of political freedom and market economies. Consider the quantity of entropy that must be managed if a human society is to successfully function. Given the vast potential of an individual human body, it is astonishing how much control is exercised in the most ordinary of human actions and interactions. The most unconventional or undisciplined people you will ever encounter still restrict their motions, facial expressions, behavior, and activity to an astonishingly narrow a range of the possibilities of which their bodies is capable. As we increase the number of human bodies interacting, the potential degrees of freedom in behavior explode exponentially. The entropy that must be controlled if an interdependent society of millions is to function—to keep its members alive, to transform the material world for succor and shelter, to defend itself against external shocks and competing societies—is unfathomable.

Viewed against a standard of perfect choreography, of zero deviation from predetermined activity, there may appear to be a great deal of freedom in ordinary human interaction. An individual may choose to eat in today or eat out, and still successfully complete their day without causing social unrest. A society may tolerate uncertainty over whether an individual will become a fireman or a physician. But viewed against the full space of possible behaviors among millions of interacting humans, the overwhelming requirements of survival and prosperity are constraint and bias. By some combination of instinct, socialization, and social control, bodies must be organized into intricate and interlocking dances that would be exceedingly unlikely if there were uniform probabilities of action on almost any level. The “freest” society would be populated by humans bounding and barking and shitting randomly, and surviving very briefly. The truest expression of liberty, in a statistical sense, is a seizure.

Obviously, when we talk about “human freedom,” then, we mean something very different than mere entropy or unpredictable behavior. Even in a relative sense, comparing ranges of behavior within different societies, unpredictability fails to capture what we mean. The winter-day activities of a North Korean farmer may be less predetermined or choreographed than the work day of a New York office manager, yet we’d say the New Yorker “enjoys more freedoms” than the North Korean. So what precisely do we mean when we say that people are “free”?

Here is a conjecture that I think accords with our actual usage of the term: “Freedom” represents a state of coincidence between what one is constrained or compelled or allowed to do and what a person subjectively determines she “legitimately wishes” to do. Sure, a person who may choose among a number of desirable actions with no constraint is free. But so too is a ballerina bound to perform and not deviate from an intricate set of actions that she is nonetheless glad to perform. And so too is a soldier marching in lockstep in a parade of thousands, if some passion or ideology has persuaded her that marching is what she wishes to do, among the possibilities it might be legitimate for her to want.

A person may be free because she can choose among a broad range of possibilities, or she may be free while she undertakes some action about which she has no choice at all, but whose compulsion she deems legitimate. Or she may be free when she faces a range of options, one of which is clearly superior to the alternatives, so that her behavior is perfectly predictable despite a formal freedom to choose. Freedom is not, at bottom, about the range of possibilities one faces but about the degree of consent one offers for the action to be taken or the circumstance to be endured.

A “free society” then is not one that maximizes the range of actual behavior that people ultimately exhibit. A successful mass society limits and choreographs aggregate human behavior to astonishing degrees. A free society is one that (to steal from Herman and Chomsky) effectively manufactures consent for the tremendous constraint it must impose. It’s not that people do what they choose, but that they, in aggregate, “freely” choose to do what they must.

All large-scale societies—ones that you might consider good and virtuous along with ones you would consider oppressive and corrupt—require means of reducing the entropy of human behavior and directing action toward ends useful to maintaining social continuity. If you start from the premise that constraining behavior effectively is the core challenge a society must solve, Milton Friedman’s observation of the coincidence between market economies and political freedom appears in a new light. Rather than challenging authority with outside centers of power or offering some sort of ipso facto freedom, markets may instead be seen as functioning so effectively to shape aggregate behavior that alternative approaches like suppressing speech become unnecessary. Political freedoms are luxuries that can be enjoyed once not-explicitly-political means of social control (like markets) have adequately supplanted inferior technologies of suppression.

Markets are “free” even though the range of choices they offer participants may be less than ideal (would you like to work at McDonald’s or at Wal-Mart?), because the menu of options emerges from a faceless, “decentralized,” “voluntary,” even “natural” process. A free adult accepts the limits of an imperfect world in a way she might not accept restrictions imposed by identifiable humans. Means of control attended by some degree of choice, the limitations of which appear as facts of nature, may amount to a more pleasant and less disruptive way of being told what to do than, well, directly being told what to do.

This is a useful trick. No, really! Perhaps it is Orwellian, disturbing. But if you accept the premise that a tremendous amount of constraint—shall we call it “discipline”?—is a prerequisite to the successful flourishing of a large society, institutions capable of imposing constraint in a manner that, subjectively, does not engender feelings of injustice or oppression, and that, objectively, don’t provoke political conflict or even violence are incredibly useful. As instruments of discipline, markets may simply be technically superior to alternatives like hierarchical control and direct coercion.

So when people claim that the “free market” system outproduced Soviet Communism, what they are saying is that markets more effectively produced discipline. It was more successful at imposing patterns of human action and restriction conducive to military and economic production than a command economy was capable of imposing. It is fashionable (and perhaps not wrong) to interpret this superiority in Hayekian terms and claim that markets solved an information problem that bureaucracies of centralized control were incapable of solving. Markets were better at determining how behavior needed to be shaped and constrained, despite the Soviets’ secret police and the gulags. Capitalist superiority may have been a matter of more effective, less disruptive means of controlling and motivating useful behavior. Market incentives may simply have been a better instrument of control, because of the conflicts and political resistance they crucially fail to engender.

“Free markets” are a fiction, unless one adopts the cynical and unconventional definition of freedom I’ve employed above. But they are fictions we are capable of performing very well or that we are incapable of failing to perform, even in our own heads. Even if, even after, we have seen through them in some intellectual sense, they continue to compel us.

Milton Friedman, whether as propagandist or true believer (probably both), praised market coordination with unmixed admiration, but it is hard to be quite so enthusiastic when one recognizes and characterizes it as an unrivaled instrument of control. In actual fact, the control over behavior exercised by “impersonal” markets pretty clearly benefits some persons much more than others in ways we might consider illegitimate. We may dispute whether the order imposed continues to constitute a successful or decent society. If not, there is no virtue in the ability of markets to misdirect us with a velvet glove.

Actual market outcomes are based upon near infinite artificiality. The money we trade for goods and services is made of mere tokens invented and defined in a system operated by banks in a very specific sort of collaboration with states. The markets that most grandly shape social outcomes do not directly touch goods and services at all. Financial markets determine what we collectively build and do, and who bears what risk, by virtue of trade in claims on wholly abstract entities that almost incidentally transact in human labor and operate on the physical world. Once one is seduced by the capacity of markets to exercise control without appearing to do so, one is left with the neoliberal temptation to play sorcerer’s apprentice by rejiggering contracts and definitions or taxes and endowments in hopes of retaining the clever system of free and voluntary coercion that markets provide but getting better outcomes from it.

It is easy to dismiss the neoliberal impulse and call attention to its unimpressive history. But it is hard to imagine an instrument of social control with more Vaseline than “free markets.” Surely Friedman is right that a society with the perceived freedoms a market order can permit is superior to more direct authoritarianism. Perhaps what is wrong with the neoliberal approach is not the attempt to embrace markets while redefining the terms on which they operate, but the degree to which technocratic rearrangements in practice operates as a (well-compensated) substitute for non-market political action.

It may in fact be possible to rejigger the context in which markets operate in ways that meaningfully improve the shape of society. But it won’t be possible without overcoming the objections of those who most benefit from current arrangements. It is naive to imagine that operating in ways rewarded by existing market arrangements will be sufficient to reshape those arrangements in ways likely to harm those doling out the rewards. Control without conflict is the virtue of markets, but to redirect that control, a bit of hardscrabble, old-fashioned fighting might be necessary.