A review of Andrew Ross's Creditocracy

Creditocracy (n.)

• governance or the holding of power in the interests of a creditor class

• a society where access to vital needs is

through debt—Andrew Ross

If the book currently under review is any indication, Andrew Ross, a professor of social and cultural analysis at New York University, has never (or very, very rarely) met a creditor he really liked. This reader, no stranger to debt or creditors himself, is quite certain that similar attitudes are held by approximately 99.27% of all human beings extant who have undergone the experience of borrowing money. Accordingly, Professor Ross, a social activist who was instrumental to the creation of Occupy Student Debt and the Strike Debt forgiveness program, should have a very receptive audience for his message, which basically boils down to the assertion that debt is very, very bad.

What makes Ross’s tome different from advice dispensed by Suze Orman and dozens of other personal-finance mavens of greater or lesser credibility is his characterization of the socioeconomic institution of credit and his prescription for it. With respect to the former, he spends a great deal of time and effort outlining how debt and credit are inextricably intertwined with our lives and society, including personal consumption, housing, labor, climate, and long-term growth. As for his prescription for it, his message is bracingly simple: repudiate it.

Did I mention that Professor Ross thinks debt is very, very bad?

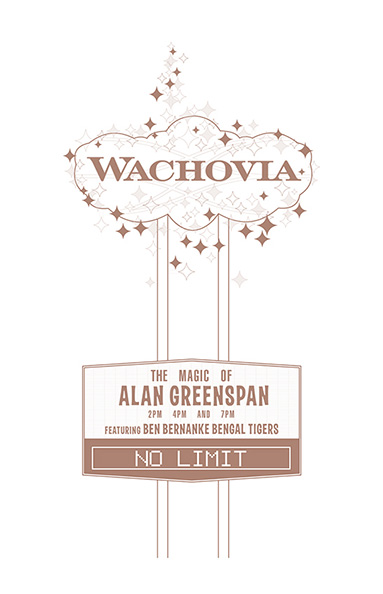

For if I did not, or if you forget between reading this article and picking up the book, you will recall it very quickly once you do. Ross is no fan of debt. He sees the current pervasiveness and economic and political power of what he has termed the creditocracy to be corrosive of our social fabric, destructive of participatory democracy, and particularly oppressive of the working poor. For the latter, he contends the current system of consumer and personal debt is but the newest incarnation of compulsory social and economic indebtedness for the poor that extends from and encompasses feudalism, indentured servitude, slavery, sharecropping, company scrip, and loan sharking. He has bad things to say about Wall Street, banks, hedge funds, payday lenders, the IMF, the World Bank, the Troika, the Club of Paris, advocates of austerity, politicians, lobbyists, Sallie Mae, Fannie Mae, college administrators, unpaid internships, student debt, revolving credit, compound interest, economic growth, Kenneth Orr, for-profit higher education, securitization, and colonialism. Did I mention debt?

Now lest you think I sport with Professor Ross or your intelligence, let me reassure you, I found his book an interesting and, in places, a compelling read. He takes pains to declare that he is neither an economist nor an expert in all things credit or financial, and he makes no effort to offer up specific policy prescriptions or economic analysis to back up his arguments. He does cite reasonably extensive secondary sources throughout, which should enable diligent readers to check his facts and draw their own conclusions about his evidence. He leavens his narrative with the occasional fact or figure, some of which are well chosen to drive home his point. He employs a serviceable and not unpleasant writing style, which makes his book more readable than a run-of-the-mill polemic. He does shoehorn the intermittent left-wing shibboleth like “monopoly capitalism,” “high interest loans,” “high carbon industrialists” (the Koch brothers), and “Wall Street” into the flow of his text, but, as one would expect, these throwaway non sequiturs seem mostly placed to remind his readers of his (and their) political bona fides rather than carry any argumentative weight.

Ross also offers up interesting historical background on the use of debt as an instrument of political control by the IMF and the World Bank in developing economies, the development of the housing mortgage market in the United States after World War II, and the source and growth of the student loan market for higher education. He avoids many basic mistakes of fact or emphasis, and the occasional slip—like the comparison of stocks (bank assets) to economic flows (GDP)—is usually not so serious as to derail his arguments. He flubs the central premise of his chapter contra economic growth, contending that lending requires growth to function. (That this is not so can be illustrated with a simple auto loan.)* He offers an entire chapter on what he titles climate debt to those of you who find such topics interesting. Sadly, this reviewer is not one of them.

However, he does make a compelling argument that the struggle between debtors and creditors has, for most people, replaced or superseded the struggle between labor and capital:

in societies that are heavily financialized, the struggle over debt is increasingly the frontline conflict. Not because wage conflict is over (it never will be), but because debts, for most people, are the wages of the future, to which creditors lay claim far in advance. Each new surrender of a part of our lives to debt- financing further consumes the fruit of labor we have not yet performed in the form of compensation we have not yet earned. Now that this condition has become inescapable, it is easier to imagine that the struggle between creditor and debtor is much older than the face-off between capital and labor that Marx proposed as a common sense explanation for economic life. After all, exploitation through debt long predates the era of wage tyranny, and its recent restoration as the most efficient means of wealth accumulation suggests that credit is a more enduring, all-weather organ of economic power.

His description of the endless treadmill of high interest, predatory lending suffered by the poor and less fortunate is believable and harrowing, and his description of the student loan market and its parasitic for-profit segment is eye-opening, and not in a good way. There is much to praise here.

And yet, given all these positives, this reviewer cannot help but feel that Ross has missed the mark. His foreground focus on the instruments and practices of debt has blinded him to an essential, incontrovertible fact: Debt is merely an instrument of economic interrelationships. A careful reader can see that Ross dances around this revelation every now and then, and even nods in its direction and alludes to its implications, but he retreats too soon to tackle the thorny fact directly. Missing this fact puts too much emphasis on the mechanism and history of the use of debt to sustain consumption in the face of stagnant or declining real wages for the majority of Americans, rather than the reason for it. Which, this reviewer believes, is ineluctably tied up with the issues and mechanisms of income distribution in the past several decades. (But that is another essay for another time.)

Ross is also not the first to confuse banks, which have increasingly taken on the role of intermediaries and originators of loans, with the holders of wealth who actually lend it out. But this is not true. Look at any bank’s balance sheet, and you will observe—as Ross correctly does at other places in his text—that banks borrow the lion’s share of what they lend out from other people: depositors, bondholders, other banks, the Federal Reserve. It’s not their money. Banks are conduits for transforming certain kinds of assets (money, investable funds) into others (loans, securities). More often than not, they transform short-term loans they borrow from their creditors into long-term loans to their debtors. This key bank function is called maturity transformation, and it is a critical, highly valuable socioeconomic service lending banks perform.

The real holders of wealth in the economy are not banks, which are only servants. The real holders of wealth are rich individuals, corporations, and institutional investors which manage trillions of dollars of their own and others’ wealth. The lion’s share of such wealth is and has always been invested in the fixed-income markets: sovereign debt, corporate loans, high-yield debt, municipal debt, and, yes, individual consumer debt in the form of securitized credit-card, auto, and student loans and mortgages. The complication, which Ross ignores, is that much of the institutional investment in fixed income is done by and on behalf of pension funds, retirement accounts, and mutual funds managed for individuals. Individuals—people, us—are the creditors we fear and loathe. Even someone with a simple passbook savings account is a lender: directly to the bank she deposits at, and indirectly to the debtors who borrow from her bank.

This is a critical point to understand. For it means that it’s not always so clear just whose ox is going to get gored if we go about repudiating debt wholesale. Ross makes a big deal about the retired city workers of Detroit being asked to reduce their pension benefits in the restructuring of the city’s debt. But Detroit’s municipal debt has been bought for years by, among others, professional fund managers on behalf of firefighters, policemen, nurses, and other public and private workers to support their pensions. By the same token, non-wealthy individuals have directly and indirectly purchased the loans and securitized debt of other individuals—i.e., made loans—to provide sources of income for their own futures. Who gets screwed if we start repudiating our credit card debt, student loans, home mortgages, and auto loans? Firefighters? Teachers? Our parents? Ourselves?

And waving one’s hands and saying the government should pick up the tab—as Ross suggests in the case of debt incurred for public higher education—just begs the question in another way. For who both lends money to government and pays taxes to pay its bills? We do, of course, directly and indirectly, in a thousand ways. Of course, we all have different exposures, both as creditors and debtors, to our governments. That, plus the fact we have different economic and political interests and preferences means we will have different opinions as to what debt, if any, should be repudiated and for whom. In other words, by focusing on the allegedly inherent evil of debt instruments, Ross elides the critical point that what needs to happen in our society is a political debate about power and inequality, not a technical debate about the mechanics of a debt jubilee.

This is the Gordian Knot we face when it comes to the problem of debt. I am sympathetic to the plight of the poor, I am outraged at the behavior of predatory lenders, and I am a firm believer in heavy regulation of consumer finance and a much heavier hand in prosecution of financial chicanery than we have yet seen. But the threads of debt shoot through our society and economy in such myriad patterns and interlinkages that it would be practically impossible for anyone to trace them all. Ross wants citizens to audit lenders for “bad” or “illegitimate” debt. But is he truly sure he or we can tell the difference? Is he truly certain repudiating “bad” debt will be good for everyone except lenders? Does he truly know who the lenders are? Who is going to pick up the tab?

Ross states he wants a “moral economy of debt.” He wants the privatization and financialization of basic human wants and needs—shelter, education, health care—reversed and taken out of the hands of private lenders, presumably to be put in the hands of government or, what is another word for the same thing, our common hands. But this is not a moral decision. This is a political decision.

And the last time I checked, we made those decisions through the ballot box. If Ross intends his book to be a call to action and a spur to political discussion of the transformation of our economy, all the better. We need more individual citizens involved. But he and they might find the answers they seek are not quite as obvious or acceptable to the rest of us as he contends they are.