We may not have all died today, but 12/21/12 has indeed marked our passage over a very particular sort of event horizon: we have been overtaken by our own abstractions.

Today, the venerable New York Stock Exchange is accepting an offer to be acquired by a much, much younger trading platform called The Intercontinental Exchange or, more chillingly, ICE.

And while pundits galore will explain that this has to do with American regulation of markets making them less attractive or profitable, the story is really much simpler and more grotesque.

It starts with the real - or the almost real. The New York Stock Exchange is, primarily, a place and a platform where people sell shares of companies to one another. The stock market. ICE is a bit more complex, or one level more abstracted, in that its principal business is to administrate the sales of derivatives.

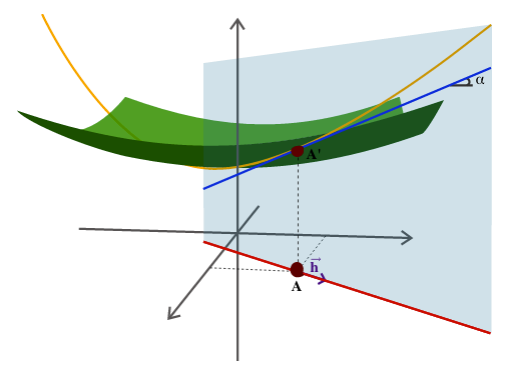

Derivatives, as the words implies, are one or more levels of abstraction away from real stocks. Where a share of stock represents some small percentage of ownership of a company, a derivative - like a futures contract - is just a bet on the future price of the stock. When you buy or sell a derivative, you are not investing in a company but in the price movement of the shares. It's one level abstracted.

Of course, you can also buy derivatives of derivatives - bets on the movement of derivatives prices - or even derivatives of those. Exchanges like ICE also let you bet on volatility or the changing rate of volatility.

The amazing thing here is that the derivatives market is now so much bigger than the "real" market, that it has gone ahead and purchased it. The transactions abstracted from the reality of the marketplace are now more important than the marketplace itself. It's kind of like when The Simpsons became a bigger mainstream hit than the sitcoms it was satirizing, or when the deepest level down in Inception turned out to matter more to reality than reality.

In terms of hoisting corporate capitalism on its own petard, this is the best moment in finance since Wall Street Journal's editors - who had always argued in favor of corporate takeovers - began whining about how their takeover by Rupert Murdoch would "kill the culture" of the newspaper. Ha.

Likewise, stock traders have always justified their extraction of value from our economy as a form of investment. In reality, stock transactions account for more economic activity than real economic activity, such as people buying stuff and companies making stuff. The majority of money has been trapped in this faux marketplace of paper, which is why however much the central bank prints, it never ends up paying for workers or projects or bridges or schools. Productive assets are less profitable than paper - but Wall Street has argued that this is just the way corporate capitalism works.

Now they're learning their own lesson, having become the mere signifier in someone else's sign. They're going to look back on the era when people used to signal sixteenths of shares with their fingers as the golden age of analog trading - before capitalism slipped over the event horizon into an infinite regression.