Economists and financiers have a useful term of art: a Minsky moment. A Minsky moment, named after the late economist Hyman Minsky, occurs when investors, encouraged by easy credit and rising asset prices, borrow money in order to reap even greater profits. So long as prices continue to rise, these leveraged investors can make interest payments on their debt and still come out ahead—way ahead. If, or when, the bubble bursts, however, and prices fall, their creditors come calling. In order to answer these margin calls, investors must sell off assets. But since it takes many investors to make a bubble, many of whom will also have taken on considerable debt, when the market pops, many other suddenly overleveraged investors must also answer margin calls and sell off assets. Cruelly, this rush to sell drives down prices, meaning investors have to sell still more assets, which further drives down prices, which leads to more margin calls, which, in the context of a bursting bubble, leads to more fire sales, even lower prices, even more margin calls, and so on. A Minsky moment. Or, in common parlance, when the shit hits the fan.

In recent years, we have lived through our very own Minsky moment. In late 2007, the housing bubble burst, and in the months that followed investors were forced to sell some of their remaining securities, which drove down prices even further. Worse still, some of those securities, the notorious collateralized debt obligations, proved to be worthless. Banks did not help matters either. Needing to solidify their bottom lines and fearing that other banks and investment funds might declare bankruptcy at any moment, they hesitated to lend to distressed borrowers and called in more loans than usual. That led to a credit crunch, which made the costs of borrowing even higher, which—well, you get the picture. Too much debt, falling prices, and not enough credit combined to bring the global financial system to its knees. Only through the extraordinary efforts of the Federal Reserve, which acted as lender—and investor—of last resort, did the global financial crisis turn into a Great Recession rather than another Great Depression.

Even so, that Great Recession has caused immense suffering. You might think, then, that the ideas that aided and abetted the rise and fall of the housing bubble, and that undercut the global financial system, would have suffered their own Minsky moment. That is, as the housing bubble burst, as foreclosures mounted, and as unemployment skyrocketed, what buyer could possibly be found for a peddler of an idea like the efficient-markets hypothesis? The hypothesis holds that when it comes to valuing economic assets, the market knows best. Indeed, in extreme versions, there can be no such thing as irrational exuberance or asset bubbles. If that were true, though, the market would never have handed out million-dollar mortgages for condos in Miami that now sell, when they do sell, for the price of a nice car. By all rights, the efficient-markets hypothesis should have all the value of a penny stock. It should be as intellectually bankrupt as Lehman Brothers is financially bankrupt.

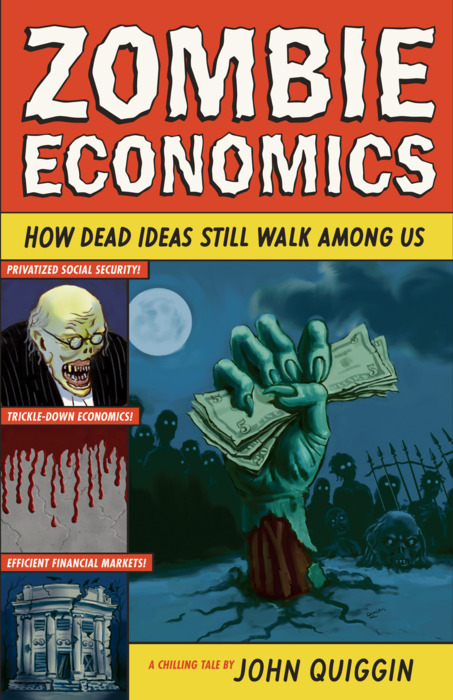

For the most part, that is true. Few people that matter are willing to buy into the efficient-markets hypothesis. Put another way, the global financial crisis pounded the last nail into the efficient-markets coffin. However, as John Quiggin, a renowned professor of economics at the University of Queensland, writes in a new book Zombie Economics: How Dead Ideas Still Walk Among Us, the efficient-markets hypothesis and a clutch of other discredited, seemingly lifeless ideas, have lately clawed their way back from the dead. In addition to the efficient-markets hypothesis, Quiggin examines four other ideas, each of which formed a pillar of economic thought in the last thirty years, and each of which failed miserably to predict, prevent, respond to, or in some cases even acknowledge the recent financial crisis. For the sake of posterity, here are the names of the dead: the Great Moderation, the belief that, following the deep recession of 1982-1983, the economy had entered a new era and left behind volatile booms and busts; Dynamic Stochastic General Equilibrium, which argues that macroeconomic phenomena can—and must—be derived from microeconomic models; Trickle-Down Economics, which holds that policies that benefit the well off ultimately benefit everyone; Privatization, the idea that whatever the government does, private firms could do better; and, of course, the Efficient-Markets Hypothesis, which assumes that when investors floated pets.com $82.5 million in its initial public offering, it was not because they were possessed by a tech-stock mania but because they had different, better information than everyone else.

Quiggin writes the postmortem—and post-postmortem—on each of these ideas, surveying their birth, life, death, and ghoulish undeath. He is out to do more than just slay zombies, though. He is also trying to perform his own kind of necromancy. In his case, the dead ideas belong to economists like Hyman Minsky and, further back, those of the master himself, John Maynard Keynes. Like Orpheus, Quiggin travels through the underworld of neoclassical economics in order to retrieve his lost love, Keynesianism. Only a revived and revised Keynes, Quiggin argues, can prevent the kind of crises that periodically lay waste to economies and livelihoods. In the final pages of each chapter, and in the final pages of the book, Quiggin outlines a research agenda for the economics profession, one that would be motivated, as the economist Willem Buiter puts it, not by “the internal logic, intellectual sunk capital, and aesthetic puzzles of established research programs” but by “a powerful desire to understand how the economy works,” including “how the economy works during times of stress and financial instability.” “The Global Financial Crisis,” Quiggin concludes, “gives the economics profession the chance to bury the zombie ideas that led the world into crisis and to produce a more realistic, humble, and above all socially useful body of thought.” “We need a newer Keynesianism,” he insists.

All of this makes Zombie Ideas a powerful, practical book. Someone had to write it, and few are better suited to the task than Quiggin. It does have its problems, though, even in addition to the obvious one—if the great financial crisis did not kill off these zombie ideas, Quiggin’s book is not likely to either. (“History,” Quiggin acknowledges, “teaches us that we rarely learn from history.”) No, the problems occur, to borrow the lingo, at both the micro and macro levels. On the micro level, parts of the book, especially the literature-review section of the chapter on Dynamic Stochastic General Equilibrium, read like they were written by one of those robo-signing machines banks use to process foreclosures. Similarly, Quiggin occasionally abandons his general audience, and the discussion becomes overly specialized. (Sample sentence: “Real business cycle advocates recognized the existence of fluctuations in aggregate demand and employment but argued that such fluctuations represent a socially optimal equilibrium response to exogenous shocks such as changes in productivity, the terms of trade, or workers’ preference for leisure.” Exactly!) You can perhaps forgive Quiggin this last sin, though, since, quite frankly, what you and I think matters considerably less than what economists teach and practice. As Keynes himself wrote in the opening pages of his General Theory of Employment, Interest, and Money, “if my explanations are right, it is my fellow economists, not the general public, whom I must first convince.”

On the macro level, the problems are at once more abstract and more worrying. Although he acknowledges the problem, Quiggin never fully confronts why economists abandoned Keynes in the first place. They would no doubt argue that they had no choice. Keynes, that is, suffered his own Minsky moment. Keynesian policies could not prevent the recession that began in 1973 and lasted until 1975, nor could they do much to aid the recovery from that recession. As the story goes, the 1970s mixed sluggish growth, soaring inflation, and high levels of unemployment into a truly dysfunctional economy. At the time, Keynesians struggled to explain this unprecedented stagflation. Traditionally, soaring inflation accompanies rapid growth and low unemployment—not slow growth and high unemployment. Conventional Keynesian policies could fix one or two of these problems, but not without making another one worse.

Quiggin is aware of this unsolved mystery. He repeatedly refers to “the chaos and failure of the 1970s,” “the real and perceived failures of the past,” and the “serious failures in the dominant version of Keynesian macro theories.” It is also why, among other reasons, he calls for a “newer Keynesianism.” But he also keeps postponing the postmortem. Quiggin might contend that answering the question of why Keynes failed would entail another, different book, a book that only the book he did write makes possible, and perhaps that is right. Still, in killing off zombie ideas, it is not enough to explain why they will not die. You must also explain why they were born in the first place, and why the ideas you would offer in their place are themselves neither dead nor undead.

Similarly, Quiggin acknowledges but does not completely escape from one of the principal dangers that has thus far afflicted discussions of the global financial crisis and the recession that followed. Too often, as in Nouriel Roubini and Stephen Mihm’s otherwise essential Crisis Economics, the discussion revolves around how to prevent booms and busts and how to keep them from disrupting the real economy. Stated positively, these arguments are concerned with how to return to normal. Yet normal will no longer do. Even before the dot-com bust and the very mild recession that followed, to say nothing of the housing bubble and the very serious recession that followed, wages for the average worker had stagnated while most of the gains of the economy had found their way to the top 10, five, and one percent of earners. A newer Keynesianism, as Quiggin knows but could state more forthrightly, must do more than just stabilize the economy. It must fundamentally realign how the economy distributes its goods.

And that raises a final question, all but neglected by Quiggin, which is whether a newer Keynesianism could truly resurrect the Golden Age of capitalism that shimmered between 1947 and 1973. During that Golden Age, the economy routinely grew by 10 percent or more per quarter and, more importantly, that growth went to the bottom 90 percent of earners at least as much if not more than it did to the top 10, five, and one percent. Since 1973, neither of those things has happened for any extended period of time. Growth rates are down, and inequality is up. (Since 1974, the quarterly growth rate has exceeded 10 percent exactly once, way back in 1978.) That may be because the United States exchanged Keynesian macroeconomic policies for neoclassical-market fundamentalism. More likely, though, is the argument Paul Baran and Paul Sweezy made in the occasionally daft but nevertheless prescient Monopoly Capital, which is that “the normal state of the monopoly-capitalist economy is stagnation.” According to Baran and Sweezy, after a period of rapid growth, mature capitalist economies would settle into a permanent stagnation. To some extent, countries could fight off that stagnation through expanded military spending, the financialization of the economy, and increased borrowing, but sooner or later these would fail, and the country would have to come to terms with its new normal of diminished growth. To me, that story sounds an awful lot like the last thirty or so years of capitalism in the United States. To put it in another way, the economy may have changed in ways that not even a revived and revised Keynesianism could fix.

The times make it easy, perhaps too easy, to cultivate pessimism about the future of the economy, but more than pessimism alone makes Baran and Sweezy seem like they might have captured something important about modern capitalism. If so, then the zombies will not be ideas but us, left to fight over the corpse of domestic capitalism.

Unlike Orpheus, then, Quiggin could stand to take a longer look behind him at how his Eurydice, Keynes, did, is doing, or will do. If not, the liberalism that Quiggin tries to resurrect risks looking like another movie monster, not the zombie but the mummy. Recall Boris Karloff’s performance in the 1932 film of the same name: His mummy is decrepit, unraveling, pursuing old loves, and ultimately lifeless. So too, I fear, is today’s Mummy Left, willing to trade one ghoul for another.